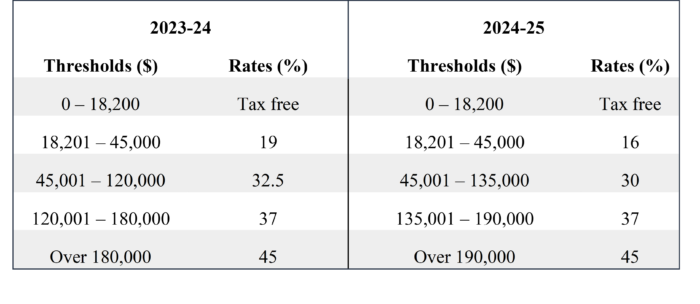

From 1 July 2024, all 13.6 million Australian taxpayers will receive a tax cut, as rates have reduced and thresholds changed.

- The 19 per cent tax rate will reduce to 16 per cent

- The 32.5 per cent tax rate will reduce to 30 per cent

- The threshold above which the 37 per cent tax rate applies rises from $120,000 to $135,000

- The threshold above which the 45 per cent tax rate applies rises from $180,000 to $190,000

To estimate your tax reduction use Treasury’s Tax Calculator.

The government has also increased the Medicare levy low-income thresholds by 7.1 per cent for singles, families, seniors and pensions, in line with inflation.

- Individuals with a taxable income of up to $26,000 will not pay the Medicare levy. The full 2 per cent levy will be payable once earnings reach $32,500.

- Seniors and pensioners with a taxable income of up to $41,089 will not pay the levy. The full 2 per cent levy will be payable when earnings reach $51,361.

- Families earning up to $43,486 will not pay the levy, wiith the full 2 per cent payable at $54,807.

For detailed tax advice please contact us on (02) 9908 9888.